President Trump pauses tariffs for most nations but slaps 125% on China. Markets soar; EU, Canada cheer. Global trade realigns—July 8 is the next flashpoint.

EU Welcomes Pause, Eyes Tariff-Free Trade

The European Union, hit hard by earlier tariffs, embraced the suspension. European Commission President Ursula von der Leyen hailed it as a move to “stabilize the global economy,” renewing her call for a “zero-for-zero” tariff agreement with the US Germany’s Chancellor-designate Friedrich Merz echoing her beliefs, crediting European unity and advocating for fully tariff-free trade. The EU sends $576 billion in goods—like cars and machinery—to the US annually (2024 data). A deal could keep prices steady; a $30,000 Volkswagen Golf might avoid a $3,000-$6,000 hike. For American shoppers, it’s a shot at affordable European imports.

Canada Gains Breathing Space

Canada, exporting $421 billion to the US yearly (2024 figures)—including oil, lumber, and vehicles—benefits quietly. The earlier tariffs threatened a 15% jump on crude oil, which makes up 40% of US oil imports. This pause, running to July 8, 2025, offers negotiation time, likely stabilizing gas prices ($4 a gallon instead of $4.50). No official statement has emerged, but Canada’s poised to secure steady trade. Near the border, cheaper lumber could keep a $500 deck project within reach.

China Hit With 125% Tariffs

China faces the steepest challenge with the 125% tariff, up from 25% in 2024, targeting its $400 billion in US exports—like electronics and apparel. Retaliation could follow, perhaps raising tariffs on the $150 billion in US goods it imports, such as soybeans. For US consumers, the stakes are high: China supplies 80% of rare earths for batteries and 30% of semiconductor parts. A cutoff might add $100 to iPhone costs or push Ford F-150 prices past $40,000. It’s fewer “Made in China” labels, but higher bills could follow.

India’s Opportunity

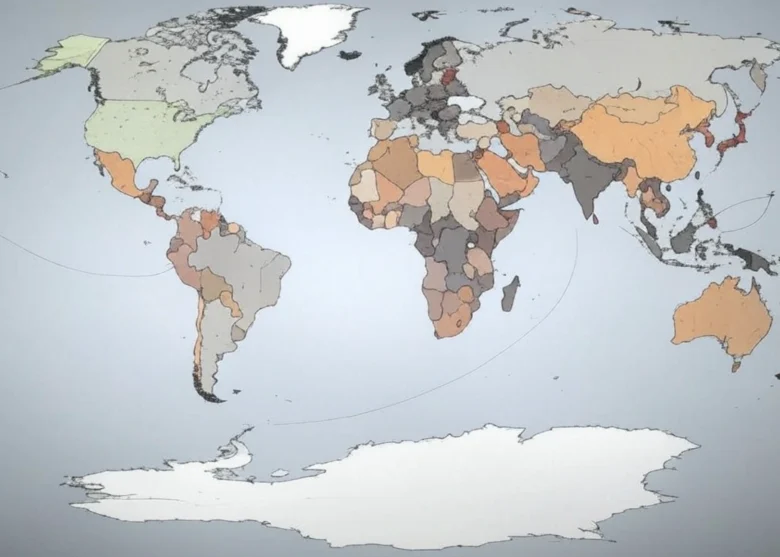

Trade Figures vis-a-vis Trump’s Tariff Suspension

The US imports $3.1 trillion annually (2024 estimate), with the EU at 19%, Canada at 14%, and China at 13%. Pausing tariffs for most but hiking China’s reshuffles the deck—allies could claim more of that $3.1 trillion if talks succeed. Markets reflect this: India’s rally mirrors the US’, with sectors like oil and pharma driving gains. For consumers, it’s a split outcome—cheaper imports from partners, but pricier tech if China’s sidelined.

Shifting Trade Alliances

This suspension, expiring July 8, splits trade into new camps. The EU and Canada might deepen ties, pursuing deals that lessen US sway long-term. China could counter with its $1 trillion Belt and Road push, redirecting goods elsewhere. US exports ($1.8 trillion in 2024) might dip if allies pivot. For everyday life, expect more European cars or Canadian lumber on the market, but fewer Chinese gadgets—and possibly higher costs if supply chains falter.

Looking Ahead

The 90-day window is a chance to ease tensions with most trade partners, but the situation still remains . Success with the EU and Canada could hold gas at $4 or keep imports affordable. A China standoff might mean $50 more for a smartwatch by year’s end. By July, we’ll know if this pause steadies the economy or sparks a bigger trade shakeup.

NEW TRUTH SOCIAL FROM PRESIDENT TRUMP:

🇨🇳125% TARIFF ON CHINA

🌎90-DAY PAUSE & LOWERED 10% RECIPROCAL TARIFF FOR OTHER COUNTRIES🚨EFFECTIVE IMMEDIATELY pic.twitter.com/Gt5Bd6276m

— The White House (@WhiteHouse) April 9, 2025